Business confidence assessed

The latest business confidence survey seems to paint a steady, if unspectacular, picture of the Isle of Man's economy since April last year.

Taken every six months, the survey is carried out to gauge business activity, optimism, planning, staffing and investments for all sectors of the Manx economy.

It's carried out by the Economic Affairs Division of the Cabinet Office.

The reference period for the current document is six months either side of the start of November 2018, with each sector being taken in turn.

Manufacturing - (10.7% of Manx economy)

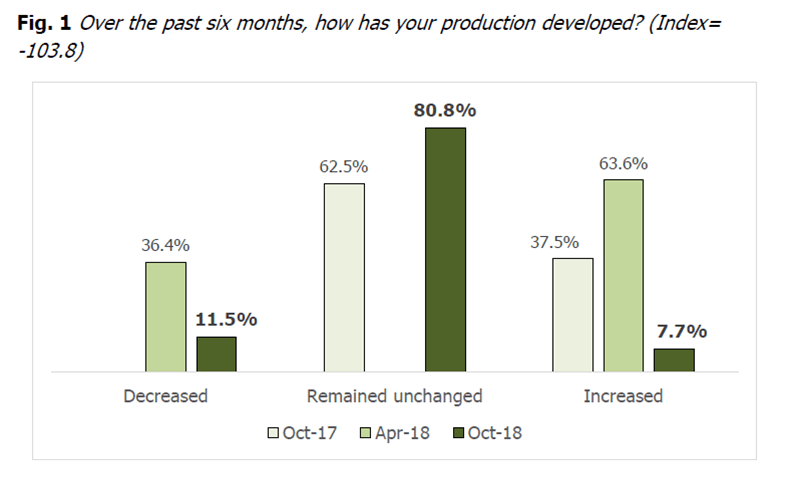

Manufacturing production remained mostly flat in the six months prior to that, with just over 92% of businesses in the sector saying they experienced no growth (80.8%) or a decline (11.5%):

Those figures are the same for orders.

When it comes to books and exports books, not a single business said they considered them to be more than sufficient.

Just over 47% say their production is being hampered by financial constraints or a shortage of labour, with the figure being split evenly between the two factors.

Looking ahead (from November 2018 to April 2019), 88% of businesses in the sector expected their production to remain unchanged.

For employment in the sector, staffing levels decreased (38.2%) or remained static (55.9%) between April and October 2018.

Despite that, there was some optimism about hiring more staff in the following six months, be they full-time, part-time, or a mixture of the two (38.3%).

Services - (43.8% of the Manx economy)

This is a varied and wide-ranging sector, covering everything from education to e-gaming, media to medical services, tourism and transport and much more.

Growth appears to be stronger than in manufacturing, but more than two-thirds of businesses said their business had remained unchanged (53.8%), or had deteriorated (15.2%)

Shortage of labour is the most common reason for limiting growth (23.8%).

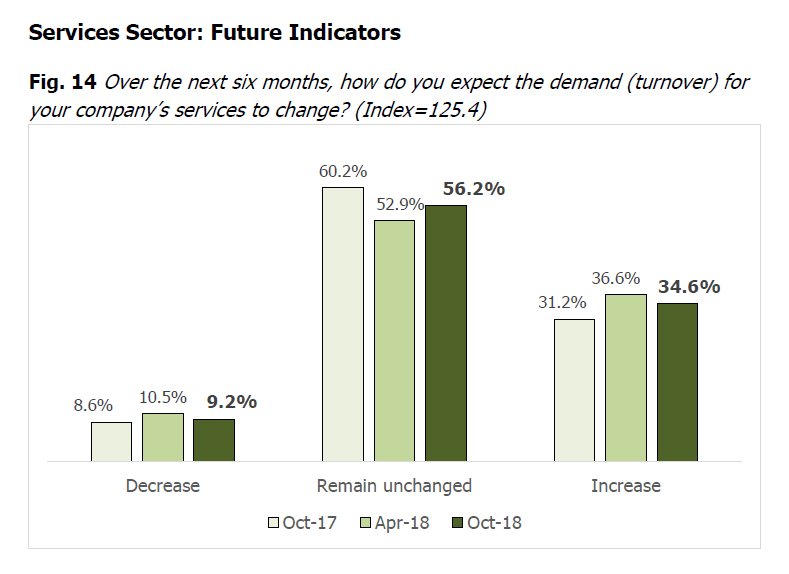

Looking ahead, most businesses felt demand would remain unchanged (56.2%) or decrease (9.2):

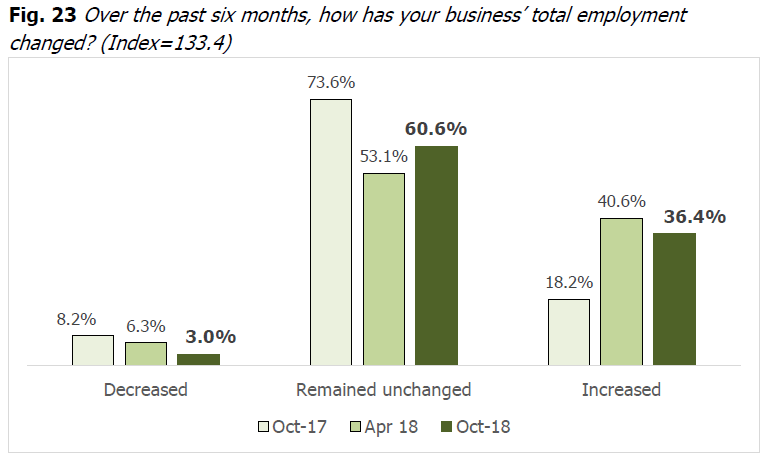

Employment, again, is very flat.

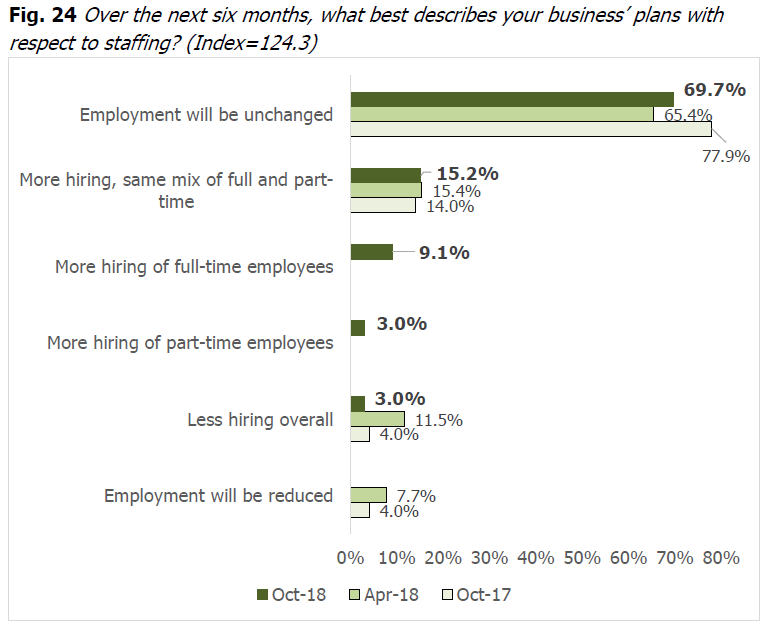

Almost three-quarters (74.8%) said it had remained unchanged between April and October 2018, and 58.8% said they expected that to be the case between October 2018 and April 2019.

Retail and wholesale - (14.1% of Manx economy)

Here, the picture is more positive, with 42.4% of those surveyed saying their sales had increased, while 39.4% said they had remained unchanged.

Between October 2018 and April 2019, those expecting their sales to go up dropped to 36.4%, while just over two-fifths (42.4%) expected them to stay the same.

Employment-wise, the sector is relatively buoyant:

Construction - (7% of the Manx economy)

Just over half (50.8%) saw no growth, but 31.1% did, meaning a decline in business was experienced by just shy of one-fifth of companies (18%).

A shortage of labour in the sector is seen as being the biggest obstacle to growth, with 22.4% of respondents saying so.

Overall order books were deemed to be sufficient (79%) or more than sufficient (16.1%).

And almost 91% said their employment had remained unchanged (63%) or increased (27.8%) between April and October last year, with the following six months anticipated to be similarly positive.

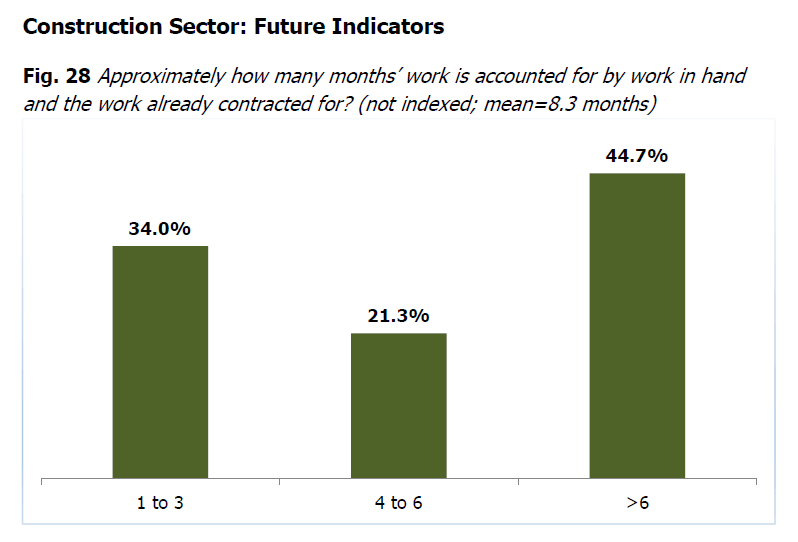

Future work was also looking pretty good:

Financial services - (24.4% of the Manx economy)

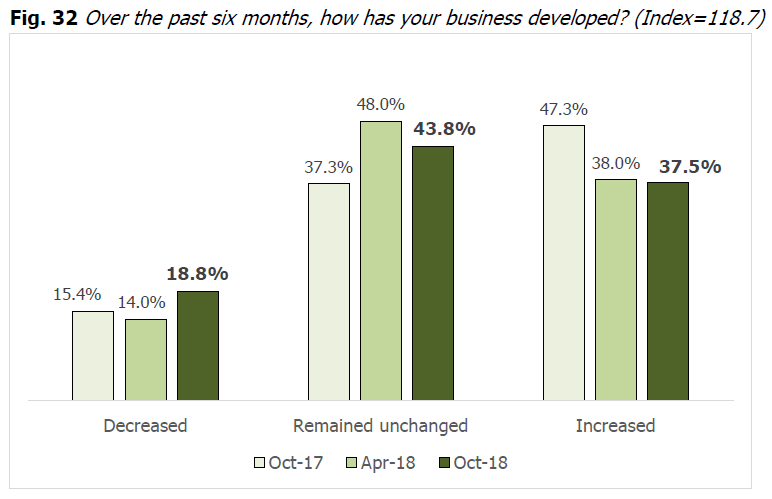

Here, twice as many businesses have experienced growth (37.5%) than have seen a decline (18.8%):

Operating income grew for 40% of them, but operating expenses grew for 56.3% of those surveyed.

Profitability was very even across the board: 35.5% saw a decrease; 32.3% remained unchanged; and 32.3% saw an increase.

Between October 2018 and April 2019, more than half of businesses were expecting turnover, operating expenses and profitability to remain unchanged, while more than three-quarters felt the same about capital expenditure.

Employment during the first six months covered by the survey was mostly unchanged (53.8%) or grew (38.5%), while in the second six months it was expected to stay the same by more than half of those asked (57.7%).

Satisfaction at-a-glance

Using a scale instead of percentages here, employers are generally less satisfied overall with the cost of services (two to two-and-a-half out of four) than they are with the quality of them (two-and-a-half to three out of four).

Within the manufacturing sector, employers in general manufacturing are most confident in the skills of young workers, but employers in the sub-sectors of agriculture/fishing/forestry and food and drink manufacture are least confident.

Almost half of respondents to offer an opinion (46.2%) don't think the Island's education system is responsive to the needs of the labour market, with 30% feeling it is 'somewhat' responsive.

Employers in the retail/wholesale sector currently express the highest opinions of the Island’s education system relative to other sectors, and employers in manufacturing are most likely to feel the Island's education system isn't responsive enough (75.0%).

Overall, when it comes to satisfaction with the work permit system, 58.8% of those surveyed say they are are 'satisfied' (51.4%) or 'very satisfied' (7.4%), while 15.5% said they were 'dissatisfied' (12.5%) or 'very dissatisfied' (3%), while the rest said it was not applicable to their business.

The picture is not so good when it comes to the planning system, though.

More people said they were 'dissatisfied' (23.3%) or 'very dissatisfied' (14%), than were 'satisfied' (28.7%) or 'very satisfied' (just 1.7%)

The remaining 32.3% said it didn't apply to their businesses.

When it comes to regulation, the manufacturing sector is most likely to disagree that it is fair and proportionate (55.1%), and to disagree that the purpose of regulation is clear (55.5%); the sector most likely to disagree that compliance is easy is the financial services sector (52.0%).

Employers in construction are most likely to agree it is easy to do business on the Isle of Man (84.6% agree), while the lowest level of agreement comes from employers in manufacturing (50% disagree).

Exactly half of the companies surveyed across the sectors said they would recommend the Island was a good place to do business, while 38.2% said they 'somewhat' would.

The rest (11.8%) said they wouldn't.

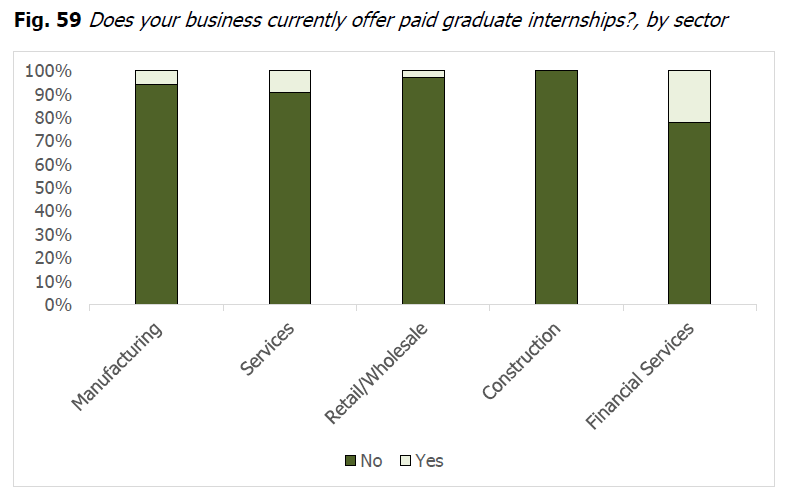

Among other figures in the survey, there don't seem to be many paid graduate internships offered:

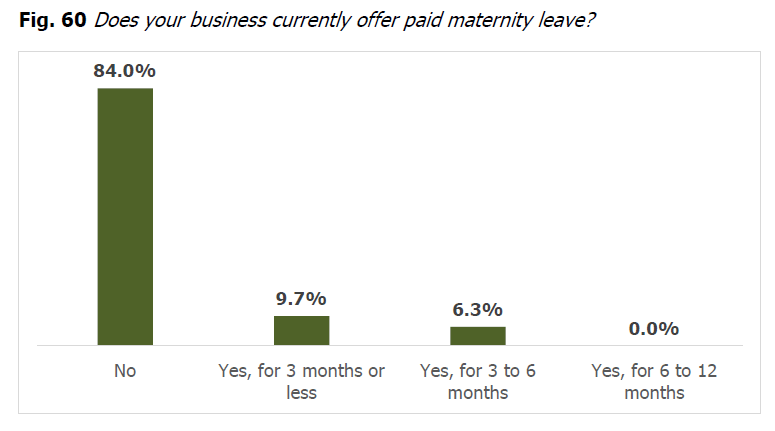

And there is a real lack of paid maternity leave offered, too

Eighty-four per cent say their business currently offers no paid maternity leave, while one-tenth offer three months or less:

More than a third of businesses surveyed (36.4%) still don't know what impact Brexit will have on them, while 22.2% think they will be worse off.

Just 3% expect it to be better, while the rest (38.4%) don't think it will have any effect.

Farmers could be left 'high and dry' by tariffs response

Farmers could be left 'high and dry' by tariffs response

Will the impending arrival of Wetherspoons to Manx shores impact the local music scene?

Will the impending arrival of Wetherspoons to Manx shores impact the local music scene?

Thirty nine babies born in March

Thirty nine babies born in March

Fines of nearly £22k issued for Income Tax and NI offences

Fines of nearly £22k issued for Income Tax and NI offences