In new reports just out, the Organisation for Economic Cooperation and Development has singled out some jurisdictions as " falling short of what was required" in terms of transparency and regulation.

The Organisation observed that many financial centres, both onshore and offshore, were making progress in improving transparency and international co-operation to counter offshore tax evasion, but some still fell short of international standards that have been developed over the last seven years.

The OECD went on to suggest that significant restrictions on access to bank information for tax purposes remain in three OECD countries (Austria, Luxembourg and Switzerland) and in a number of offshore financial centres (e.g Cyprus, Liechtenstein, Panama and Singapore). It further argued that a number of offshore financial centres that committed to implement standards on transparency and the effective exchange of information standards developed by the OECD’s Global Forum on Taxation have "failed to do so".

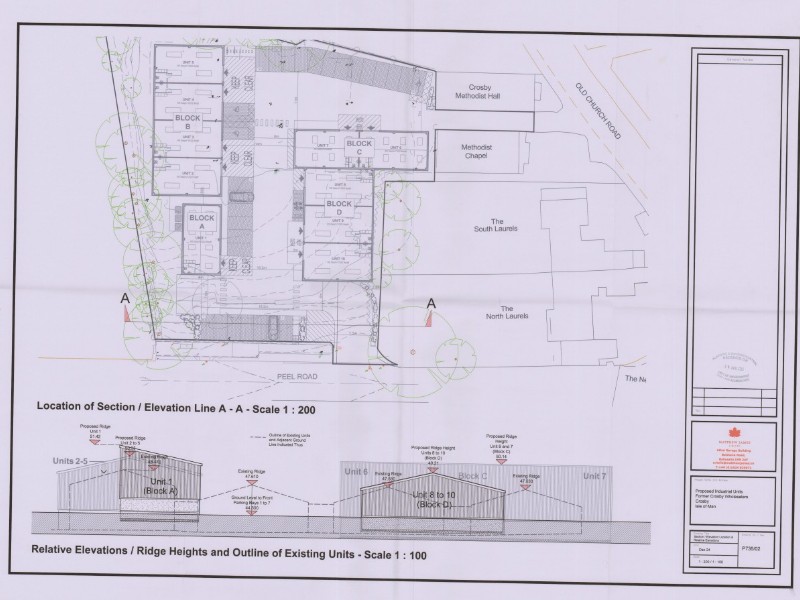

Plans for 10 industrial units in Crosby refused

Plans for 10 industrial units in Crosby refused

Corporate income tax return deadline fast approaching

Corporate income tax return deadline fast approaching

Vet practice expanding farm and equine services

Vet practice expanding farm and equine services

MHK calls for minimum wage rise to be implemented in phases

MHK calls for minimum wage rise to be implemented in phases