New measures introduced to ease concerns regarding submissions of tax returns

The treasury minister has announced that because of the coronavirus pandemic, several changes have been made to this year’s tax return process.

Paper tax returns due to be posted to individuals on or around 6 April will be delayed, but registered users of online tax services will receive returns as normal.

The Tax Division will be reviewing the postponement of posting paper tax returns by 30 April and may consider extending the current submission deadline.

If necessary, people who require a paper tax return during April should contact the Income Tax Division on 685400.

The deadline for employers’ tax returns has been extended from 5 May to 5 June.

First and second penalties will not be issued for the non-submission of outstanding company tax returns due to be submitted by 5 June.

If returns still outstanding on 5 June are liable to the second penalty, the second penalty will then be issued.

The processing of retirement pension forecasting will be suspended until further notice.

Steam Packet freight vessel heading for Western Isles

Steam Packet freight vessel heading for Western Isles

Sunset Lakes Announces Opening Date and New Family-Friendly Dining Offering

Sunset Lakes Announces Opening Date and New Family-Friendly Dining Offering

Lord Street development recommended for refusal

Lord Street development recommended for refusal

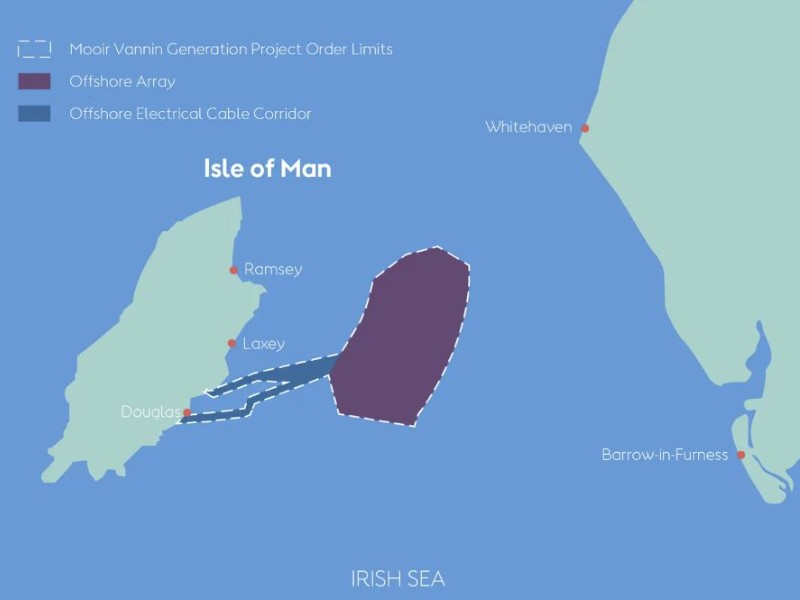

Reminder to register for offshore wind farm hearings

Reminder to register for offshore wind farm hearings