.jpg)

A British cash and carry firm says it's to talk to the provisional liquidators of Kaupthing Singer and Friedlander over a fifth of its shareholding.

Twenty-two per cent of Booker Group was owned by Kaupthing Capital Partners and is now being held by PricewaterhouseCoopers on behalf of KSF.

Booker is the largest food wholesale operator in the United Kingdom, and will move from the Alternative Investment market to a main listing in July.

The firm's chief executive Charles Wilson says he would like to talk to the receivers about what will happen to the shares as the failed bank is liquidated.

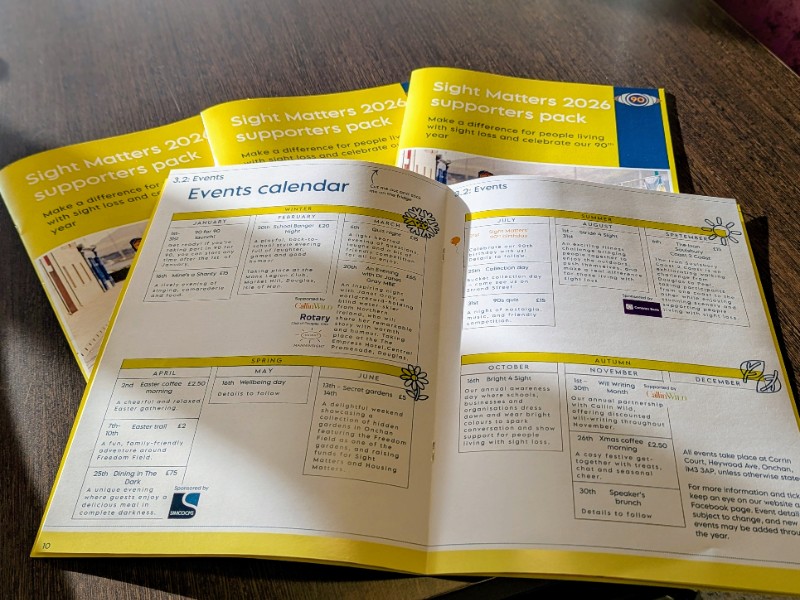

Sight Matters marks 90 Years with packed programme of events

Sight Matters marks 90 Years with packed programme of events

Minimum Wage Committee agrees with rate change

Minimum Wage Committee agrees with rate change

Reduction in minimum wage rise "positive across the board", says Chamber president

Reduction in minimum wage rise "positive across the board", says Chamber president

Changes to IOM Post Office operations are coming, but no closures

Changes to IOM Post Office operations are coming, but no closures